Investing in mid cap companies provides greater potential for long term wealth creation potential through participation in the early stage of their business life cycle.

Midcap stocks have relatively less research coverage compared to large caps. This presents an opportunity to invest in a company that is yet to be identified by the market and which is available at relatively attractive valuations.

Fast growing or emerging sectors that show a potential for growth and profits have more small & mid cap companies to invest in.

Mid cap stocks tend to have less research coverage compared to large cap stocks which makes it difficult for investors to evaluate & monitor them. Choosing a fund with a strong fundamental focus could be a simpler route to gaining exposure to mid cap stocks.

We believe investing in midcap stocks requires a disciplined approach to risk management as well as well-researched stock selection.

Generally, the fund invests in strong companies that have improving and sustainable business fundamentals and which are managed by a strong management and are available at relatively attractive valuations.

Note: Market capitalization as per SEBI circular: A) Large Cap: 1st-100th company in terms of full market capitalization. B) Mid Cap: 101st-250th company in terms of full market capitalization. C) Small Cap: 251st company onwards in terms of full market capitalization.

Note: Market capitalization as per SEBI

circular: A) Large Cap: 1st-100th company in terms of full market capitalization.

B) Mid

Cap: 101st-250th company in terms of full market capitalization.

C) Small Cap: 251st

company onwards in terms of full market capitalization.

| Investment Style | An equity scheme with focus towards mid cap stocks |

| Investment Objective | To provide income distribution and / or medium to long term capital gains. Investments would be focused towards mid-cap stocks. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The scheme does not assure or guarantee any returns |

| Fund Manager | Satish Chandra Mishra (Managing Since 09-Mar-21 and overall experience of 15 years) |

| Assistant Fund Manager | Abhinav Sharma (Managing Since 09-Mar-21 and overall experience of 15 years) |

| Benchmark | Nifty Midcap 150 TRI |

| Minimum Investment/ Multiples For New Investment | 5,000/- and in multiples of 1/- thereafter |

| Additional Investment/ Multiples For Existing Investors | 1,000/- and in multiples of 1/- thereafter. |

| Entry Load: | Not Applicable |

| Exit Load: |

|

| Product Label | TATA Mid Cap Growth Fund | Nifty Midcap 150 TRI |

|---|---|---|

|

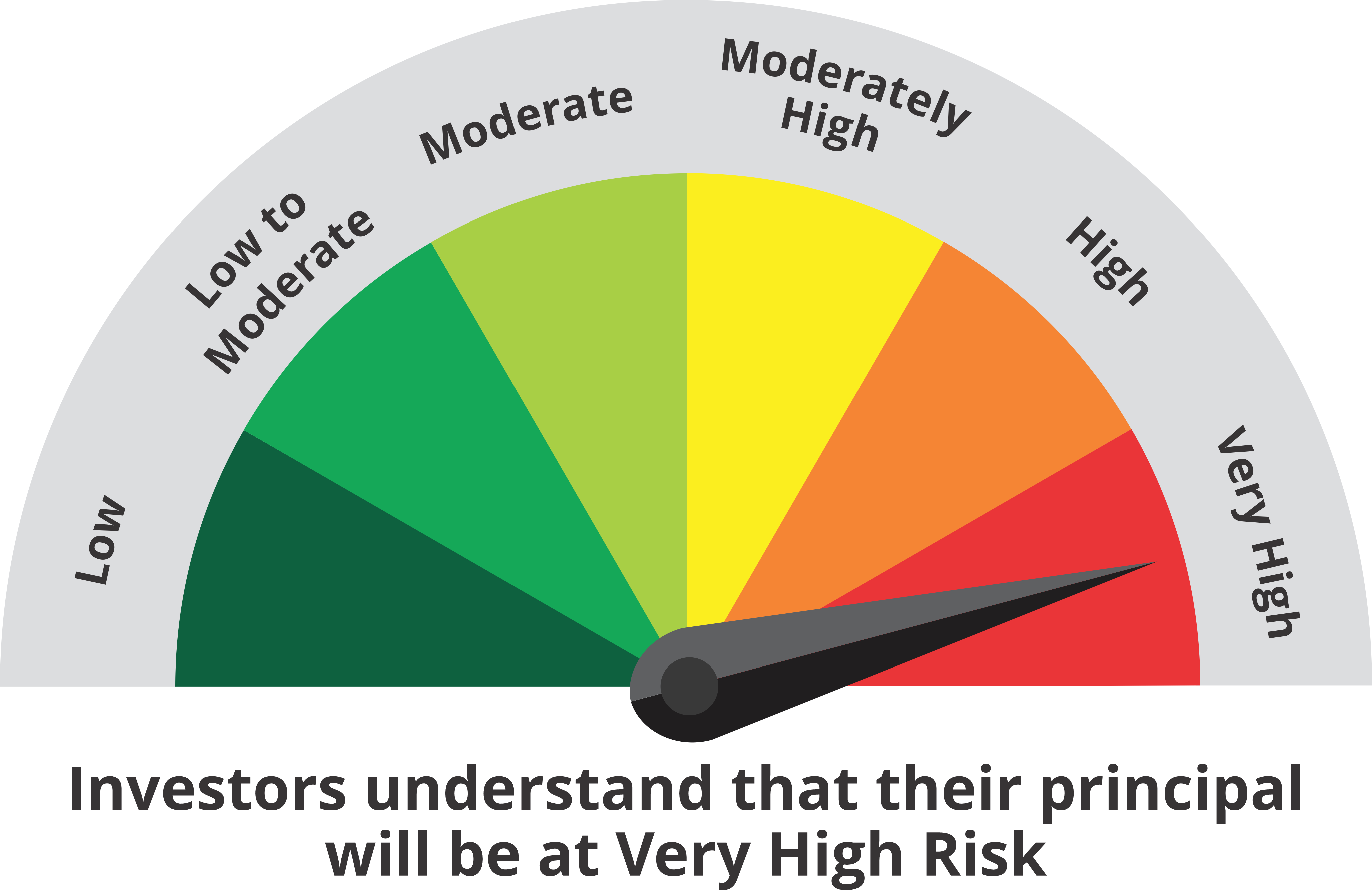

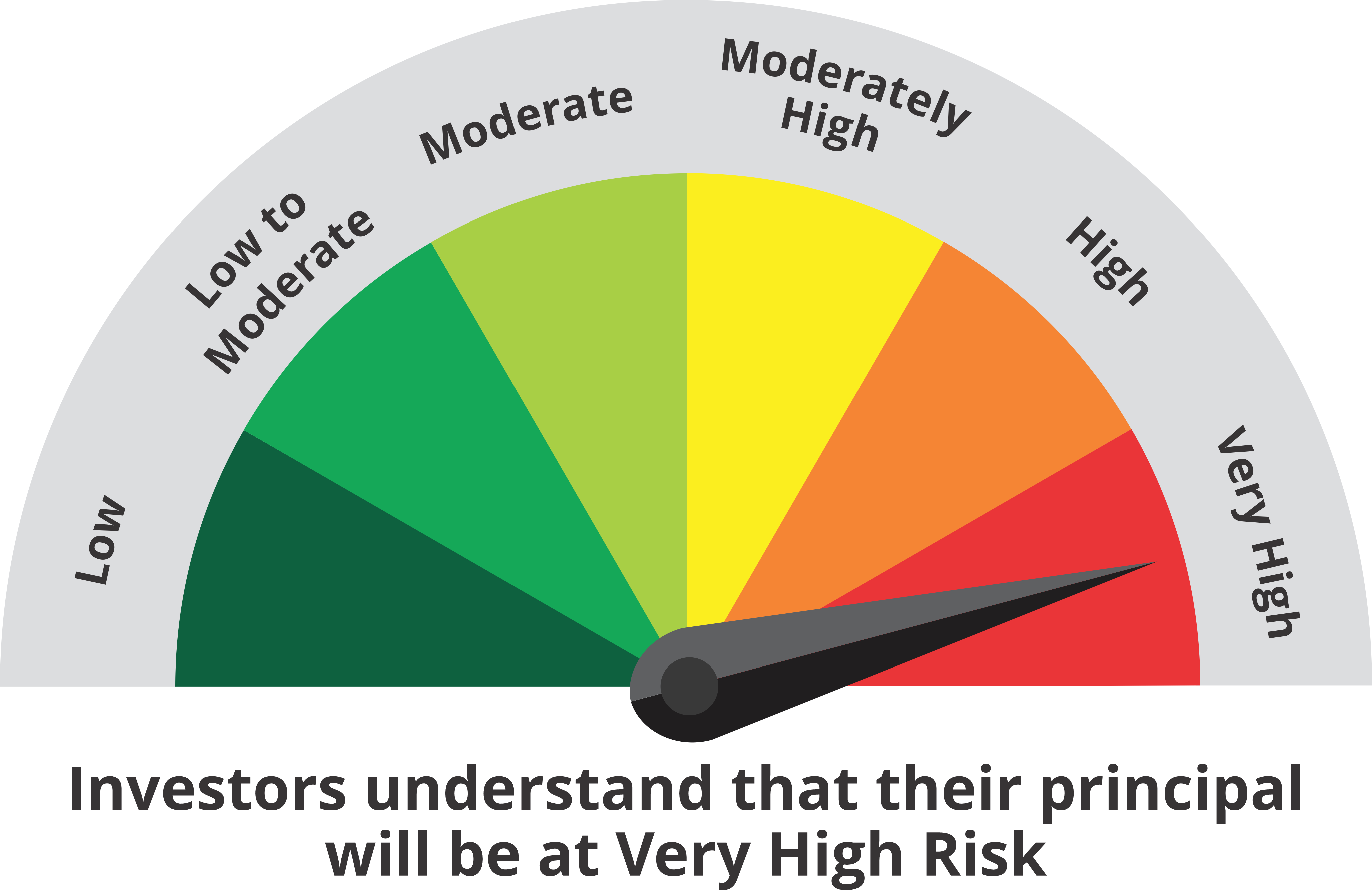

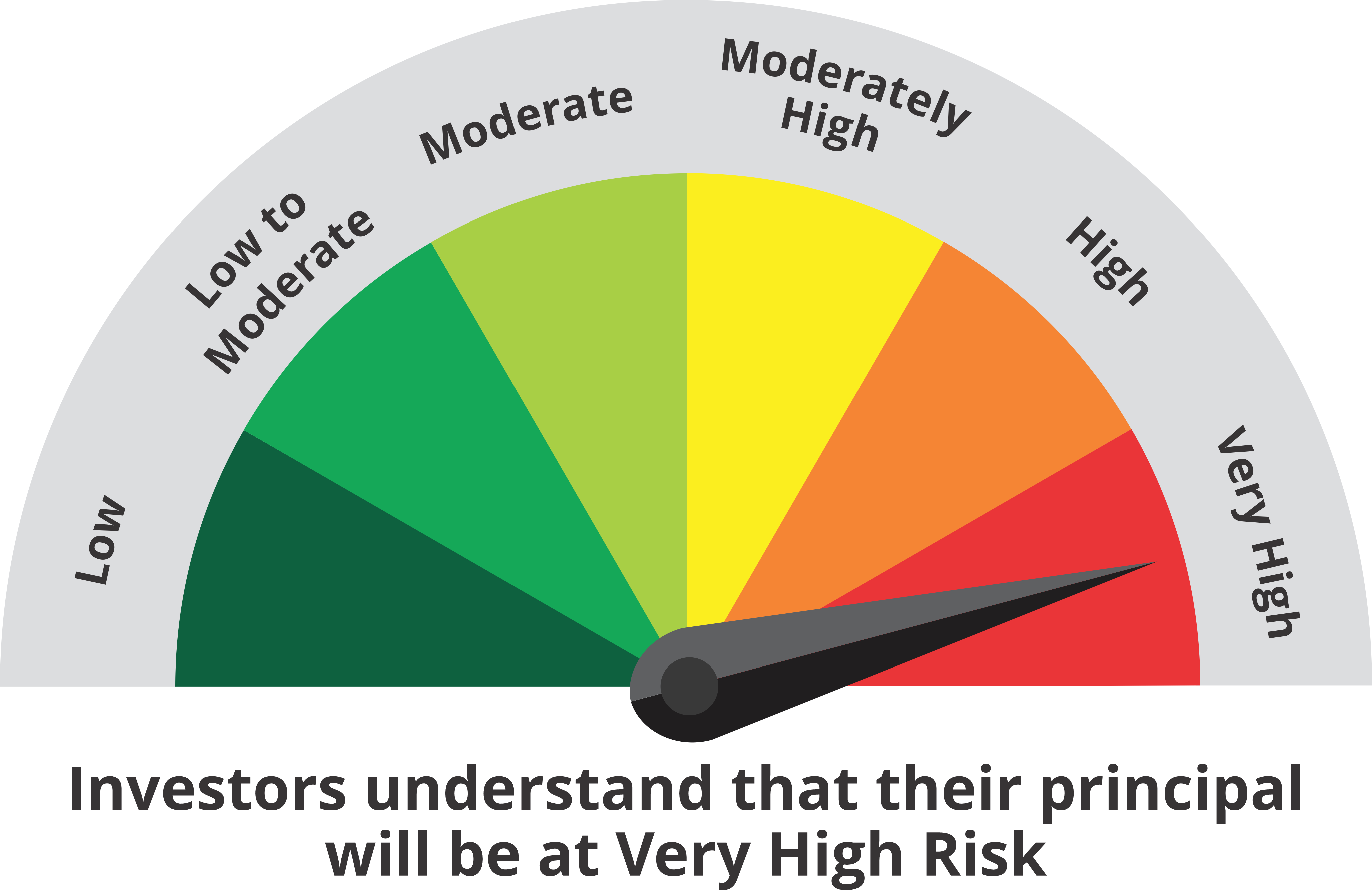

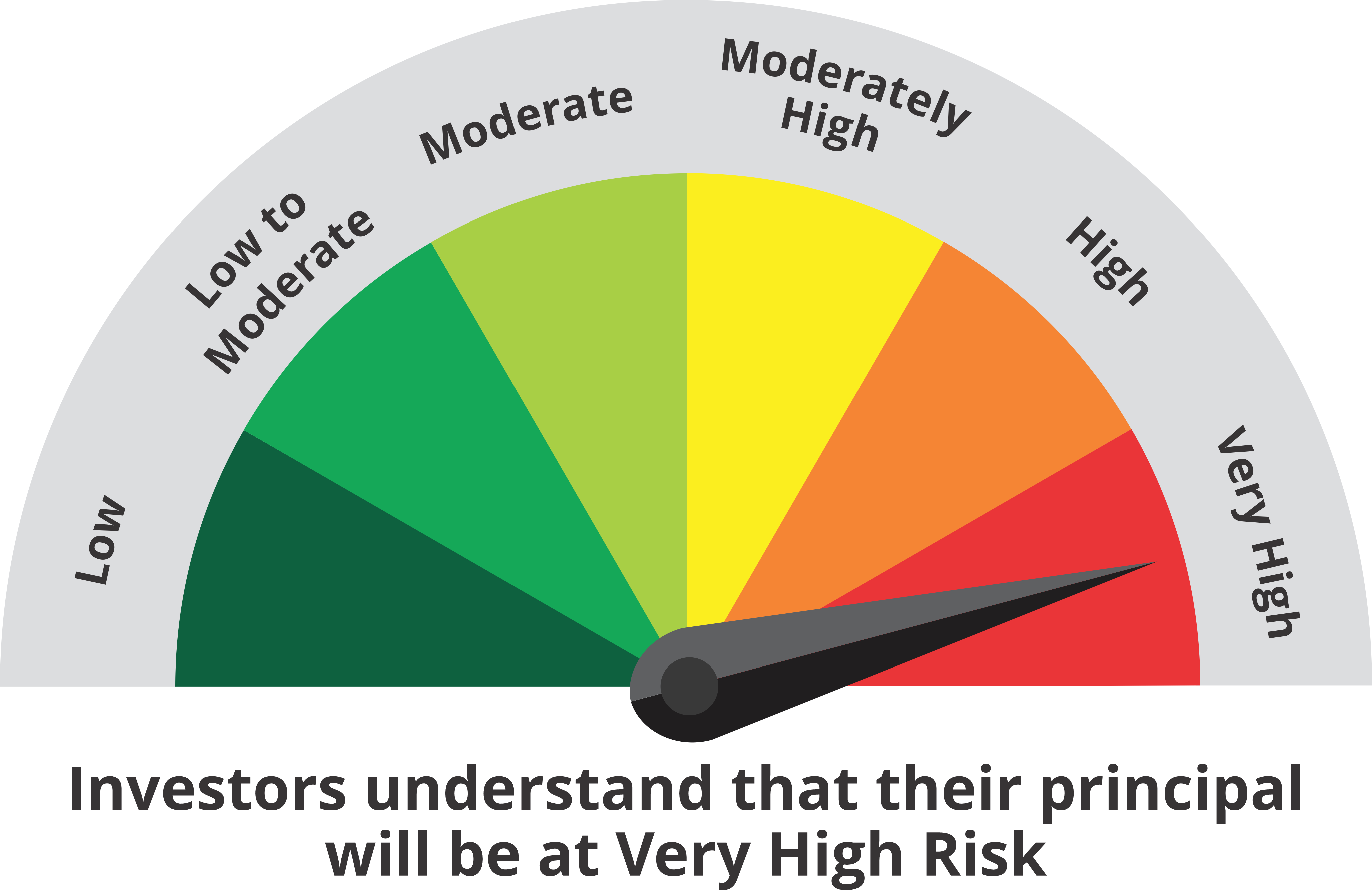

This product is suitable for investors who are seeking*:

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them. |

|

|

This product is suitable for investors who are seeking*:

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

Corporate Office Address:

Tata Asset Management Private Limited, 19th floor, Parinee Crescenzo, ‘G’ Block, Bandra Kurla Complex, Opposite MCA Club, Bandra (E), Mumbai – 400051